Table of Contents

Introduction

Knowledge of the specific policy terms in Cyber Insurance Coverage SilverFort becomes essential for businesses to prevent costly damages and maintain their operational future because the annual cost of cyber incidents will reach $10.5 trillion by 2025 according to Cybersecurity Ventures. The consequences of data breaches can result in both monetary losses plus operational issues along with legal expenses and damaged reputation without regard to the size of an organization. This guide explores how Cyber Insurance Coverage SilverFort’s framework combines modern technology advancements to link risk management practices with policy frameworks which support business development requirements.

The Rising Need for Cyber Insurance

Cyber Threat Landscape in 2024

The capability of cyberattacks keeps growing more complex as their dimensions grow larger in scale.

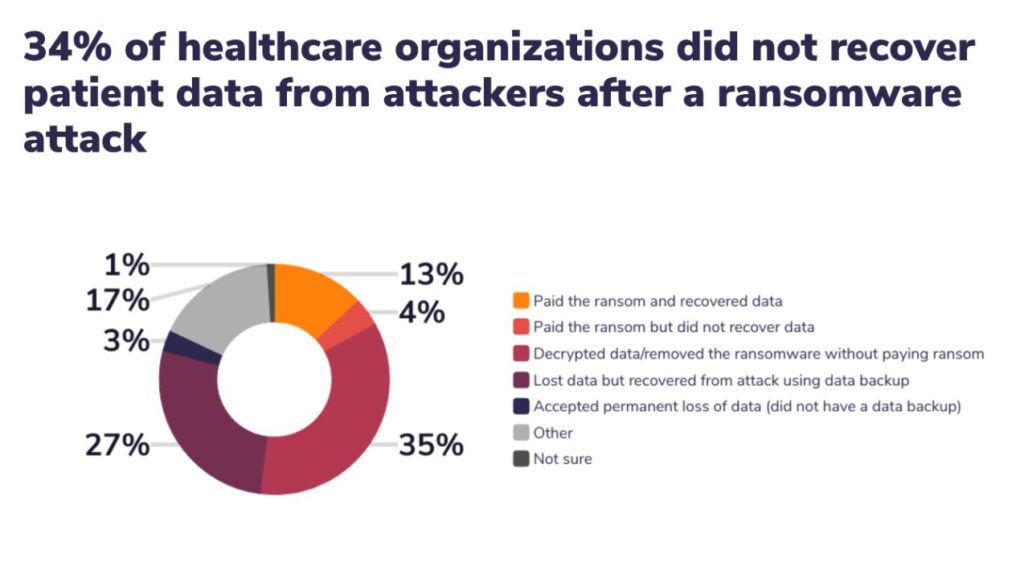

- Ransomware attacks The Sophos report indicated a 93% growth in ransomware assaults with £1.5 million being featured as the typical ransom amount in 2023.

- Supply chain breaches According to data analyzed by IBM such supply chain breaches which resemble SolarWinds attacks make up 62% of all incidents.

- AI-driven attacks Generative AI tools enable attacker techniques to bypass existing security systems when attackers use them to develop new attack methods.

Why Cyber Insurance Matters

- Financial Protection: The organization uses its cyber-insurance funds to finance public relations initiatives which assist stakeholders in building trust following a data breach.

- Reputation Management: Organizations spend their funds on public relations activities for stakeholder trust restoration through reputation management initiatives following security incidents.

- Compliance: Through its system the platform helps organizations meet their regulatory obligations for GDPR along with HIPAA and CCPA.

To grasp the insurance coverage details of a SilverFort cyber policy business operators must fully comprehend these essential safeguards active against modern threats.

What Is Covered Under a Cyber Insurance Policy

First-Party Coverage

Standard business first-party coverage protects businesses by extending insurance benefits to their direct financial expenses:

Data Breach Response

Organizations perform forensic examinations that enable them to identify where cyber-attacks originate from.

Organizations have to spend an average of $165 for each record as a requirement to provide customer notifications and credit monitoring services according to the Ponemon Institute.

Crisis management and PR efforts.

Business Interruption

Reimbursement for lost income during downtime (e.g., $8,000/hour for mid-sized retailers).

Extra expenses for temporary IT solutions.

Cyber Extortion & Ransomware

Ransom negotiation services (e.g., Coveware).

Payment of ransom (if legally permissible).

Data Recovery

Organizations must factor the expenses of recovering their data when it is either corrupted through damage or stolen.

Third-Party Liability Coverage

The coverage enables businesses to defend themselves from third-party litigation resulting from affected client transactions and vendor disputes and regulatory complaints.

Legal Defense Costs

Multiple lawsuits target organizations because of their failures to keep data secure.

Equifax paid $700 million as part of settlement agreements along with judgments after the breach incident.

Regulatory Fines

GDPR fines (up to 4% of global revenue).

HIPAA penalties (up to $1.5 million per violation).

Network Security Liabilities

Claims from external parties whose data or systems faced impact due to breaches starting within your technology infrastructure.

Additional Coverages

- Social Engineering Fraud: The company covers reimbursement costs from financial losses that result from falling victim to phishing attacks through social engineering schemes.

- Reputational Harm:Initiatives for building brand trust through marketing campaigns demand funding resources that fight reputation damage.

- Cybercrime Reward Programs: Rewards are offered via Cybercrime Reward Programs to aid in the identification of cyber criminals.

The proactive services section of SilverFort cyber insurance coverage plays a vital role in assessing and managing risks. This is covered under SilverFort: what is covered under a cyber insurance policy.

What’s Excluded? Key Policy Limitations

Common Exclusions

Pre-Existing Vulnerabilities

Breaches stemming from unpatched software or known security gaps.

Intentional Acts

The actions of dishonest employees lead to fraudulent activities and insider threats.

Physical Damage

Your hardware damage falls under the protection of your property insurance policy.

War & Nation-State Attacks

The damages caused by state-sponsored hacking attacks like NotPetya constitute one category of loss.

SilverFort’s Enhanced Endorsements

SilverFort bridges gaps through:

- State-Sponsored Attack Riders: Optional coverage for high-risk industries (e.g., defense contractors).

- Penetration Testing Requirements: Penetration testing requirements apply as a mandatory security audit which serves as a condition for receiving benefits.

How SilverFort Transforms Cyber Insurance

Identity-Based Threat Prevention

SilverFort’s platform uses AI to:

- An early detection system operates in real time to identify attackers during lateral movement activities.

- Secure legacy systems (e.g., on-premise servers) and hybrid cloud environments.

- The implementation of Zero Trust policies must occur while maintaining uninterrupted business operations.

Incident Response Integration

- Automated Alerts: Post-breach actions begin with immediate alert notifications which go directly to both insurer departments and IT teams.

- Forensic Data Sharing: Through Forensic Data Sharing the process of claim handling becomes smoother as it provides relevant breach information.

Premium Discounts

Conducting business with the tools from SilverFort enables organizations to obtain insurance premium reductions of between 15 and 20 percent because of limited breach potential.

Case Studies: Cyber Insurance in Action

Case Study 1: Ransomware Attack on a Healthcare Provider

- Incident: A hospital’s patient records were encrypted by Conti ransomware.

- Coverage: SilverFort’s cyber insurance coverage SilverFort: what is covered under a cyber insurance policy? funded:

- $2.1 million ransom payment.

- HIPAA fine negotiations.

- Patient notification costs ($450,000).

- Outcome: The company restored operations within 72 hours without any legal actions being taken against them.

Case Study 2: Supply Chain Breach at a Retailer

- Incident: The disclosure of payment information from 500,000 customer accounts occurred due to an API security vulnerability handled by a third-party vendor.

- Coverage: SilverFort’s policy covered:

- Forensic audit ($200,000).

- PCI-DSS penalties ($1.2 million).

- Customer refunds and credit monitoring ($850,000).

Choosing the Right Policy: A Step-by-Step Guide

Step 1: Assess Your Risk Profile

- Industry-Specific Risks:

- Healthcare: HIPAA fines, patient data theft.

- Finance: Finance: SEC fines, wire fraud.

- Retail: PCI-DSS compliance, POS breaches.

Step 2: Compare Insurers

| Provider | Unique Feature | Best For |

|---|---|---|

| SilverFort | Identity threat detection | High-risk industries |

| Coalition | Active threat scanning | SMEs |

| Beazley | Breach coaching services | Multinational firms |

Step 3: Negotiate Policy Terms

- Sub-Limits: Select insurance policies that provide ransomware coverage with payout amounts higher than typical ransomware demands exceeding $1.5 million.

- Retroactive Dates: Validate breach coverage starting from the first day of the policy agreement when you buy retrospective dates protection.

Regulatory Trends Shaping Cyber Insurance

GDPR & CCPA Compliance

- Right to Audit: Insurance companies are implementing a right to audit which demands documentation of encryption systems and access control implementation from policyholders.

- Data Localization: The implementation of policies for Data Localization requirements becomes essential to handle potential security risks while data transfers across different regions.

SEC Cybersecurity Disclosure Rules

Public organizations must inform the public about data breaches within a four-day timeframe but cyber insurance policies from SilverFort now offer defense against SEC fine payments.

Future of Cyber Insurance

AI-Driven Underwriting

- Predictive Analytics: Insurance companies utilize machine learning to produce policy prices through the analysis of current threat information.

- Automated Claims Processing: The authentication of claim data happens through automated systems that utilize blockchain-encrypted logs as part of artificial intelligence processes.

Parametric Insurance

These policies compensate organizations based on breach severity metrics which includes downtime hours instead of requiring manual assessments.

External Resources or More Information

- CISA Cyber Insurance Toolkit: CISA.gov

- NIST Cybersecurity Framework: NIST.gov

- SilverFort Identity Security Platform: SilverFort.com

More Links On Helpful topics:

- Buy car insurance online for new car? 100% Safe Information With Us

- 100% Best Home Insurance Quotes Comparison Online

- 100% Ultimate Guide to Mortgage Pre Approval Requirements: What Are Pre-Approval Requirements?

- 100% Best Understanding Of General Liability Insurance

- Motorcycle Accident Lawyer:100% Best Understanding Of What to Do If There Is a Motorcycle Accident?

- Breaking Retirement Survivors Disability Insurance News

Conclusion

An organization needs to properly manage risks while implementing protective financial measures for cyber insurance coverage through SilverFort to determine its policy coverage. Protect your business with an effective policy to combat cyber risks that occur in the digital world. SilverFort achieves a new level of breach prevention through its combined identity security and insurance approach. You need to start by analyzing your risks followed by a comparison of providers to buy a policy which turns your cyber resilience into business strength.

Pingback: Breaking 2025 Retirement Survivors Disability Insurance news

Pingback: buy car insurance online for new car? 100% Safe Information

Pingback: 100% Best Understanding of General Liability Insurance: What