Table of Contents

People conducting home insurance quotes comparisons online typically begin their search to obtain the lowest rates available. The availability of home insurance quotes causes many people to worry about the impact on their credit score rating. This extensive guide will explain credit check functions during the quoting system while showing you effective online home insurance quote comparison methods and demonstrating ways to obtain budget-friendly coverage regardless of your status as a senior citizen, bundler or first-time homebuyer.

Does a Home Insurance Quotes Comparison Online Affect Your Credit?

Soft vs. Hard Credit Inquiries

An online search for home insurance quotes involves soft credit checks that will not affect your credit score. Soft pulls are used to:

Assess your financial responsibility.

Premium rates become risk-dependent following calculations in 90% of the U.S. states that utilize this model.

Home insurance brokers on the web provide initial quotes to prospective clients.

A hard inquiry leads to a 5–10 points score reduction but it only takes place when you request formal policy coverage.

States Where Credit Checks Are Restricted

Three states prohibit credit-based insurance scoring:

- California

- Massachusetts

- Hawaii

The law prohibits the use of credit history when insurers conduct home insurance quotes comparison online in these states.

How to Protect Your Credit During Comparisons

You should utilize online home insurance brokers such as Policygenius and Insurify since they conduct their checks using soft methods only.

Apply for a full coverage only when you select the insurer you want to move forward with.

Contact insurers directly for confirmation regarding whether their quote needs to execute a hard credit check.

How to Conduct a Home Insurance Quotes Comparison Online

Step 1: Gather Necessary Information

Prepare the following to streamline your search:

The required information includes square footage of the property together with its construction date and roofing system.

A person needs to determine their coverage requirements involving their dwelling together with personal belongings as well as their desired liability protection levels.

The eligibility for insurance discounts will depend on the bundling of car/home insurance policies as well as security systems along with maintaining a claims-free record.

Step 2: Use Reputable Comparison Tools

Online users can access home insurance quotes through the following platforms for comparison:

NerdWallet: Through NerdWallet users can evaluate premiums from more than ten insurers together with Amica home insurance.

The Zebra: Users can contrast home and auto insurance rates in order to find the best bundle at The Zebra.

Bankrate: Bankrate enables seniors to access filters that help them find the most affordable homeowner insurance coverage.

Step 3: Analyze Coverage and Costs

Dwelling coverage: Homeowners should check that their dwelling coverage equals their property rebuild value by using Home Insurance Calculator.

Deductibles: Premiums decrease as deductibles rise but insurance policyholders need to pay more for expenses during claims.

Add-ons: Specific coverage for floods and earthquakes needs additional separate insurance policies.

Step 4: Validate Insurer Reputation

Check:

Financial stability ratings from AM Best Company indicate an A+ grade assigned to Amica home insurance coverage.

J.D. Power claims satisfaction scores.

Internet users consult Trustpilot and Reddit’s r/Insurance subreddits to review customers.

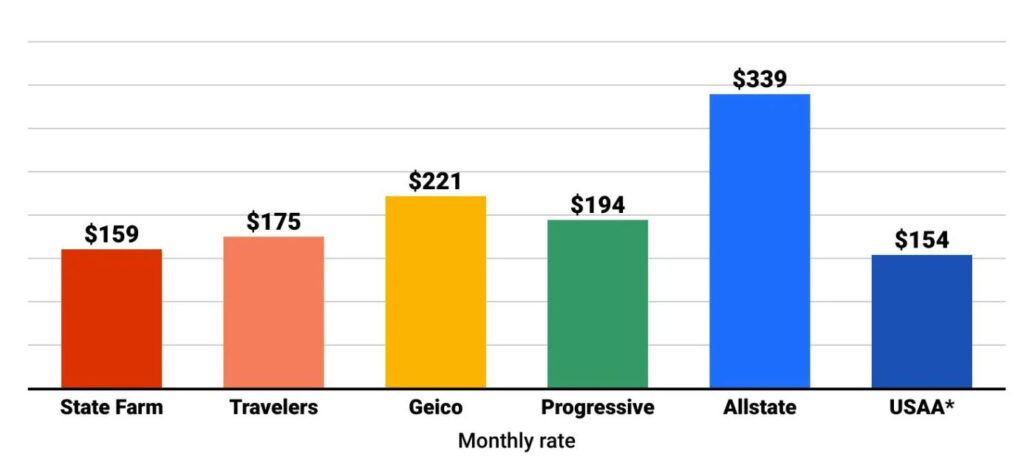

Top Providers to Include in Your Home Insurance Quotes Comparison Online

Amica Home Insurance: Best for Customer Satisfaction

Pros: Consistently high claims satisfaction ratings.

Cons: High rates at Best Choice exceed those of rivals by 10 to 15 percent.

Best for: Prioritizing service over price.

State Farm: Best for Bundling

Access a 20% discount through the online platform when you obtain home and auto quotes simultaneously.

Local agent support in all 50 states.

Allstate: Best for Seniors

Insured customers who have gone without making claims or who are retired can benefit from special discounts at a level of up to 25%.

Optional host advantage coverage for home-sharing (e.g., Airbnb).

Lemonade: Best Digital Experience

Users can receive quotes within 90 seconds because of the AI-powered platform functionality.

This platform provides quick 90-second quotes to tech-oriented customers in search of THE most affordable home and auto coverage.

Tips to Save Money During Your Home Insurance Quotes Comparison Online

Bundle Home and Auto Insurance

The average yearly savings amount to $1,200 when households select their insurance coverage from providers including State Farm and GEICO.

Leverage Age-Related Discounts

- Seniors (age 55+) may qualify for:

- Retirement discounts (5–10%).

- Loyalty rewards for long-term customers.

Improve Home Safety

Installation of burglar alarms or burglar alarms or smoke detectors or storm shutters enables up to 20% reduction on premiums.

Using impact-resistant rooftop materials enables property owners in hurricane zones to receive savings between 10–25% (total savings reach 10–25%).

Common Mistakes to Avoid

Overlooking Policy Exclusions

Floods and earthquakes and sewer backups are excluded from standard policy coverage.

Home insurance add-ons can be analyzed through online brokers to compare their prices.

Focusing Solely on Price

The cheapest insurance policy often comes without minimum essential coverage. For example:

Actual Cash Value (ACV) London Financial Market (LFM), a relevant distress model of CDS that has proven its effectiveness in meetings since its inception during the global financial crisis. CDS traders based their bids and asked prices on projections reflecting the likelihood of default and economic strength of underlying debt.

Skipping Annual Reviews

Change your home insurance quotes review online once a year to:

Adjust for home renovations.

Get new promo codes (e.g., smarthome items).

FAQs About Home Insurance Quotes Comparison Online

Can I Get Quotes Without Personal Information?

A great majority of websites will need your address and birth certificate to provide you with accurate quotes.

How Many Quotes Should I Compare?

Zigging between 3–5 warehouses represents an ideal way to manage time alongside potential savings.

Are Online Quotes Binding?

The final rates could be subject to adjustments after a proper application process and home verification.

External Resources or More Information

Investopedia: Homeowners Insurance Guide: Learn key terms and strategies.

100% Ultimate Guide to Mortgage Pre Approval Requirements: What Are Pre-Approval Requirements?

100% Best Understanding Of General Liability Insurance

Motorcycle Accident Lawyer:100% Best Understanding Of What to Do If There Is a Motorcycle Accident?

Buy car insurance online for new car? 100% Safe Information With Us

Is Cyber Insurance Coverage SilverFort Best Choice

Breaking Retirement Survivors Disability Insurance News

Conclusion:

Initiate Your Home Insurance Rates Search Through Our Online Platform Today

Performing a home insurance quotes comparison online through an effective online search provides users the quickest route to find appropriate coverage at reasonable rates without negatively influencing their credit profile. Online home insurance brokers in combination with Amica insurance allow you to safeguard your home while maintaining financial security.

Ready to save? Obtain home and auto quotes by clicking below for online comparison today.

Pingback: Breaking 2025 Retirement Survivors Disability Insurance news