Table of Contents

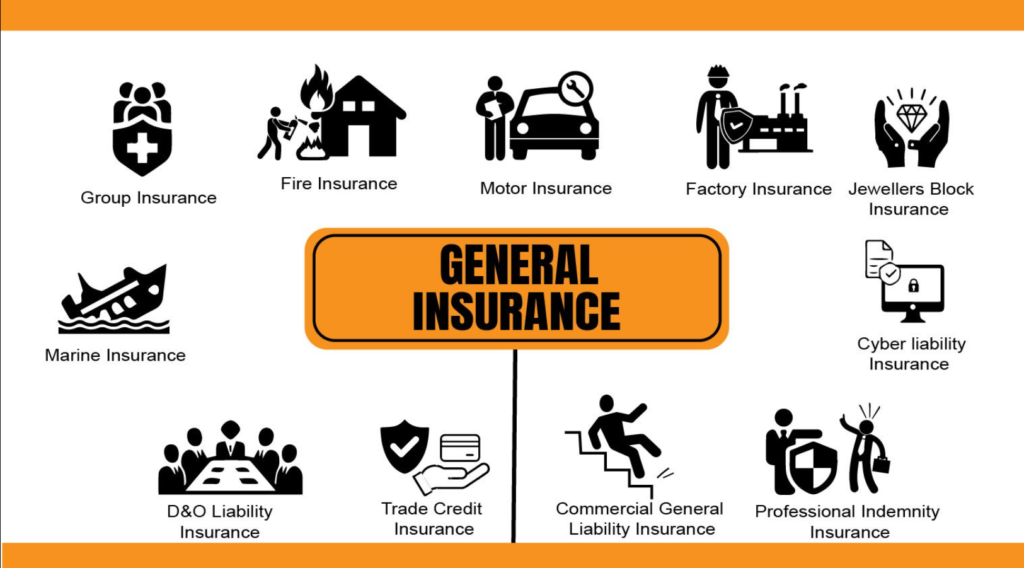

Understanding risk management has become vital within the present-day dynamic business operational environment. Having knowledge of available insurance options stands among the most fundamental aspects for safeguarding your business. These choices rest on the foundation of general liability insurance which seeks an understanding of what defines general insurance. This article explores every aspect of this topic by evaluating its historical development together with operational mechanics and explaining its critical value for all organizations regardless of size. This text explains general liability insurance: What is general insurance meaning? together with a guide for selecting the optimal variant that meets your requirements.

This guide discusses various insurance topics which include NFP insurance definition while introducing NJ insurance search tools along with Progressive 3 digit identification numbers for insurance details and information about Progressive NJ codes and NFP insurance ownership structure and GEICO insurance system for New York State and Progressive New York insurance numbers for identification. Additionally we will clarify the meaning of general insurance and its purpose and advantages. Our main goal is unravelling all aspects of general liability insurance by explaining its meaning and benefits together with its technical details.

Introduction

Insurance acts as a protective system that reduces monetary perils and protects commercial entities together with individual members from unexpected obligations. The question remains unclear about liability protection since many people seek to understand the concept of general insurance meaning. This text goes into detailed examination of the subject while establishing insurance as an essential protective element within the insurance industry framework.

Standard definitions show that general liability insurance provides coverage for businesses to defend themselves against physical injuries and damages to property that emerge from unexpected accidents or carelessness. General insurance serves as a fundamental protective measure which shields companies from financial risk through safety of reputation and continued business operations during unexpected events.

Moreover, understanding general liability insurance: What is general insurance meaning? allows decision-makers to determine the appropriate level of protection their business needs. Whether you are a startup or a long-established corporation, balancing cost with adequate coverage is key. Throughout this comprehensive guide, we will include insights, examples, and even direct comparisons with other industry-specific terms, ensuring you aren’t left with unanswered questions.

A Brief History of Liability Insurance

The evolution of insurance has been marked by the need to address the unpredictable risks that businesses face. The formal concept of general liability insurance: What is general insurance meaning? can be traced back to the early days of commerce when merchants required protection against the losses incurred due to unforeseen events. As commerce expanded, so did the complexity of risks, and liability insurance emerged as a mechanism to distribute risk among several parties.

Basic insurance principles of early policies remain inferior to contemporary insurance coverage methods. Industrial advances in addition to technological improvements created changes to economic conditions that led general liability insurance to broaden its scope: Understanding the Definition of General Insurance. Modem general liability insurance policies create customized defense which guards organizations against multiple unpredicted risks that include facility-related accidents along with unforeseen product claims. Insurance companies remain active in development because of legal complexities and requirements to manage risks properly.

According to general insurance meaning general liability insurance delivers crucial functions in contemporary business operations which led it to evolve from being a luxury to becoming an indispensable instrument. Organizations learn about present-day risk protection tools through studying how previous risks and their mitigation techniques worked in practice.

General liability insurance functions as what constitutes a fundamental form of insurance coverage that protects commercial entities. Work?

A full understanding of general liability insurance arises from investigating its practical functioning which defines What is general insurance meaning?. The main purpose of general liability insurance is to provide coverage for legal defense costs together with settlements and damages that result from proved liability claims arising from injuries and property damage to others. General liability insurance functions through multiple stages as detailed below.

- Coverage Limits:The insurance policy defines maximum compensation amounts which policyholders can receive during claims. Each insurance area has its own limitation value specified within the policy. This usually consists of bodily injury limits combined with property damage limits and personal injury limits.

- Claims Process: The insurance company conducts a comprehensive assessment to check if claims comply with policy terms. Claims management divides into three sequential steps beginning with incident reporting then complete assessment before arriving at settlement decisions that establish costs.

- Risk Management: Your business achieves better operational security when it actively encounters potential liabilities to manage operations effectively. General liability insurance provides security to stakeholders while building their trust through its protective benefits.

- Exclusions:Policies contain limitations which require clear specification of excluded risks to be included in the document. All uncovered risks must have their specific exclusions clearly documented within the policy details. The policy specifies excluding coverage for intentional damage and fraudulent acts among other conditions.

- Premium Determination:Insurance companies evaluate multiple business parameters including organization size, industry danger, geographical location, insurance history together with additional elements to determine premium amounts.

.

The fundamental characteristics which comprise general liability insurance What is general insurance meaning? establish the protective framework and explain how this coverage offers financial protection from sudden expenses.

Understanding Policy Coverage and Claims

One must fully understand general liability insurance principles including its definition under general insurance meaning when making decisions. The standard packages within these policies include the following features:

What Is Covered?

- Bodily Injury: The property insurance protects you as a business owner by paying for injured visitors’ medical costs and lost earnings and their related medical expenses during their visit to your premises.

- Property Damage:Your business is shielded from obligations to compensate third parties when unidentified property degradation occurs under this coverage.

- Personal and Advertising Injury:Personal and Advertising Injury protection extends coverage against liability claims involving libel, slander and copyright infringement that occur from personal and advertising activities.

- Legal Fees:Legal Fees are fully covered by insurance plans because they protect clients during legal battles involving litigation claims.

Through What is general insurance meaning? businesses receive defense against multiple types of liability through the explicit definition of essential factors in their general liability insurance policies. Business organizations experience less financial burden during incidents when they complete necessary preparation work in advance.

How Claims Are Processed

When a claim is made, the following steps are typically involved:

- Notification:The insured person must notify the insurance provider about the incident right away after it occurs.

- Investigation:The insurance company conducts investigations to determine what coverage applies to given scenarios along with their liability responsibilities.

- Approval or Denial: Results generated through the approval process determine payment for authorized claims but denial results from inconsistencies between test outcomes and policy criteria.

- Settlement:In case of settlement approval the insurance company assumes full responsibility for proceeding with settlement payments while also covering defense costs.

Insurance coverage that provides total risk management allows businesses to understand their potential liabilities before claims arise according to the definition of general insurance.

Key Insurance Terminology

Insurance serves as a complex domain which requires specific specialized language. Knowledge of essential jargon allows you to interpret general insurance meaning more effectively and enables better selection of insurance options. Insurance terminology contains multiple essential terms that need definition in the following section.

- Policy Limit: A Policy Limit determines the largest compensation amount which the insurer will pay when processing a covered claim.

- Deductible:An insured person must pay upfront costs from the policy known as the deductible before the insurer begins payment.

- Exclusions: The policy excludes certain specified situations and circumstances from its coverage.

- Coverage Area: The policy specifies boundaries through its coverage area that determine which geographical regions and situations trigger its applicability.

Knowledge of a few important specific terms within the industry proves helpful for professionals. For example:

- What does NFP insurance stand for, Organizations that work with nonprofit intentions fall under the classification of NFP insurance which stands for Not-For-Profit insurance.

- NJ insurance code lookup is a process often used by businesses in New Jersey to verify coding specifics related to their policies.

- Progressive insurance ID number 3 digits and What is the 3 digit code for Progressive insurance NJ New Jersey insurance code verification serves as a common tool for businesses within the state to confirm policy documentation details.

- Who owns NFP insurance The issue of ownership within NFP insurance remains a question that drives questions about how insurance companies function.

- GEICO Insurance Code ny and Progressive insurance 3 digit code NY GEICO Insurance Code ny together with Progressive insurance 3 digit code NY serve as essential tools for New York businesses to help enhance policy information inquiries.

- Auto Insurance codes Through Auto Insurance codes insurance companies achieve standardized classification methods for multiple types of motor vehicle policies.

There are essential terms to learn with a base understanding of general insurance meaning which establishes core knowledge needed to handle insurance situations capably.

The Critical Role of general liability insurance: What is general insurance meaning? for Businesses

Every business network faces various risks without regard to its size. Businesses depend on general liability insurance because it provides fundamental protection against their risks. The following section will expand on these particular points.

Mitigating Financial Risks

General liability insurance: What is general insurance meaning? helps businesses persevere when a financial liability emerges after accidents or injuries or unexpected events disrupt their operations.

- The organization needs funds to pay for both defensive and settlement legal expenses.

- You may reduce expenses associated with medical costs and property damage payments.

- Company assets together with creditworthiness stay protected through limiting direct spending on claims.

Enhancing Business Credibility

Companies with broad general liability insurance coverage project reliability and responsibility when handling unexpected occurrences to their stakeholders. Through insurance awareness customers establish better trusting relationships with both business partners and investors. Through comprehensive liability insurance protection business organizations can create stronger business partnerships that open new opportunities for organizational growth.

Protecting Against Emerging Risks

Current business operations need a well-designed general liability insurance policy because of evolving legal standards and expanding regulatory needs. A strong business presence during crises depends on insurance coverage understanding because it acts as a defensive shield which safeguards operations against industry changes and new risks.

Common Myths and Misconceptions

The essential nature of general liability insurance exists despite ongoing myths that surround this insurance concept. What is general insurance meaning? Let’s debunk a few:

Myth 1: “Liability Insurance Is Only for Large Corporations”

All businesses need general liability insurance regardless of their size according to the definition of general insurance meaning. Small businesses along with startup companies are vulnerable to claim actions that could otherwise cost them huge financial losses.

Myth 2: “I Don’t Need Liability Insurance If I’m Careful”

A single unexpected accident can be mitigated through general liability insurance which acts as a safety net for proactive measures to ensure business continuity upon preventive measures failing.

Myth 3: “All Liability Policies Are the Same”

Each policy has distinct features and dimensions as well as conditions and limitations and exclusions. The particular terms under general liability insurance: What is general insurance meaning? differ in their conditions and exclusions and limits between insurance providers and industries. A thorough analysis of policy terms should happen prior to any firm plan acceptance.

Transparency initiatives in the insurance sector address common misdirected ideas about insurance. Knowing principles of general liability insurance enables business owners to select decisions which produce substantial consequences for their financial stability.

Real-World Applications & Case Studies

The following hypothetical cases demonstrate how general liability insurance: What is general insurance meaning? creates concrete impacts in real-life situations.

Scenario 1: A Retail Store Incident

A customer who hurts themselves while slipping on a wet floor at a retail store will face long-term medical interventions as part of their recovery process. General liability insurance steps in to pay defense costs and compensation payments when someone files a claim in this scenario. The absence of insurance protection would force the store owner to pay for all settlements out of pocket which could have catastrophic financial consequences.

Scenario 2: A Product Liability Claim

When manufacturing flaws cause property destruction and bodily harm the manufacturer can rely on their general liability insurance. A well-written general liability insurance “What is general insurance meaning?” policy will protect manufacturers from paying excessive legal costs and settlement amounts while preserving their business operations during substantial claims.

Case Study: Navigating a Complex Claim

A technological company of medium size faced a legal claim after a contractor obtained injuries during a corporate gathering. The estimated claim value started at high six figures that would cause financial instability for the company. The company’s General Liability insurance policy covered all claims so the firm could successfully reduce the effect of this incident. The insurance provider took full responsibility for handling every aspect of the claims procedure so the company could concentrate on business expansion and innovation by eliminating legal headaches.

The insurance policy known as general liability stands as a crucial business asset which shields organizations against unexpected risks in these scenarios.

The Importance of Industry-Specific Insurance Codes

The insurance industry created specialized codes to assist industries in both identifying claims processes while ensuring more efficient handling of claims. To obtain customized insurance coverage businesses require understanding specialized insurance codes. For example:

- NJ insurance code lookup:New Jersey insurance code lookup represents a familiar reference for businesses operating within the state who need to verify policy details and ensure compliant claim processing.

- Progressive insurance ID number 3 digits:The NJ insurance code lookup functions as a common verification tool for New Jersey businesses to check insurance policies while guaranteeing correct state regulations for claim handling.

- What is the 3 digit code for Progressive insurance NJ: The Progressive insurance NJ policy identification requires a three digit code that serves as a critical element for New Jersey policyholders to access their coverage data.

- GEICO Insurance Code ny: The GEICO Insurance Code ny serves as a reference for New York businesses to check their policy information with GEICO.

- Progressive insurance 3 digit code NY: The Progressive insurance 3 digit code NY functions as an essential resource for New York policyholders which makes claims procedures simpler.

- Auto Insurance codes: Insurance companies benefit from standardized codes known as Auto Insurance codes which optimize claim processing efficiency mostly in automobile and commercial fleet insurance contexts.

Learning these codes improves your understanding of the insurance system and your knowledge of general liability insurance principles defined by what general insurance meaning encompasses. The set of codes promotes understanding between insured people and their healthcare providers and facilitates quick communication.

The Benefits of general liability insurance: What is general insurance meaning? for Small and Medium-Sized Enterprises

Many small to medium-sized businesses battle with constant risk challenges when they try to grow their operations. The value of general liability insurance stands out in such environments: What is general insurance meaning?

- Financial Protection: SMEs face serious financial challenges because they maintain smaller capital reserves than their corporate counterparts yet general liability insurance: What is general insurance meaning? provides financial stability to avoid business interruption following catastrophic incidents.

- Credibility & Trust:Professional coverage establishes trust among clients and contractors as well as financial institutions due to its liability protection function. The presence of liability protection indicates that the business operates under competent management while maintaining preparedness in case of unforeseen events.

- Operational Continuity: The coverage of general liability insurance: What is general insurance meaning? provides immediate assistance to maintain operational continuity during incidents that otherwise could disrupt productivity or lead to workforce disputes.

To obtain a policy that meets their needs business owners should build a partnership with their insurance brokers. An evaluation of business location along with industry risks and historical claims data helps insurance brokers create policies that meet specific business requirements for general liability insurance: What is general insurance meaning?.

Tips for Choosing the Right general liability insurance: What is general insurance meaning? Policy

Selecting the ideal insurance coverage for your business demands careful consideration. Below are some tips to guide you through the process and ensure that you select a robust general liability insurance: What is general insurance meaning? policy:

1. Determine Your Risk Exposure

- Assess the Hazards: Your assessment should evaluate the existing risks that come from working within your industry sector. Businesses that require public contact or manufacturing should determine their hazardous potential is significantly higher.

- Review Past Incidents: A review of past incidents leads to risk detection through analysis of historical claims data.

- Consult Industry Experts: Collaborating with industry professionals provides the knowledge needed to develop a specific general liability insurance: What is general insurance meaning? policy.

2. Compare Multiple Policies

- Coverage Options:The insurance policies should cover various situations such as bodily injury along with property damage and personal injury to provide complete protection.

- Exclusions: Policies must have broad coverage provisions which defend against bodily injury events and property damage happenings and personal injury lawsuits.

- Premiums and Deductibles: Review premium rates and deductible amounts so your coverage provided remains affordable in both short-term and long-term periods.

3. Seek Professional Guidance

An experienced insurance broker together with a risk management consultant provides crucial assistance to comprehend the complexities of general liability insurance by addressing its meaning Through their professional expertise they aid companies in making appropriate insurance policy decisions to match their particular business situation.

4. Stay Informed of Industry Trends

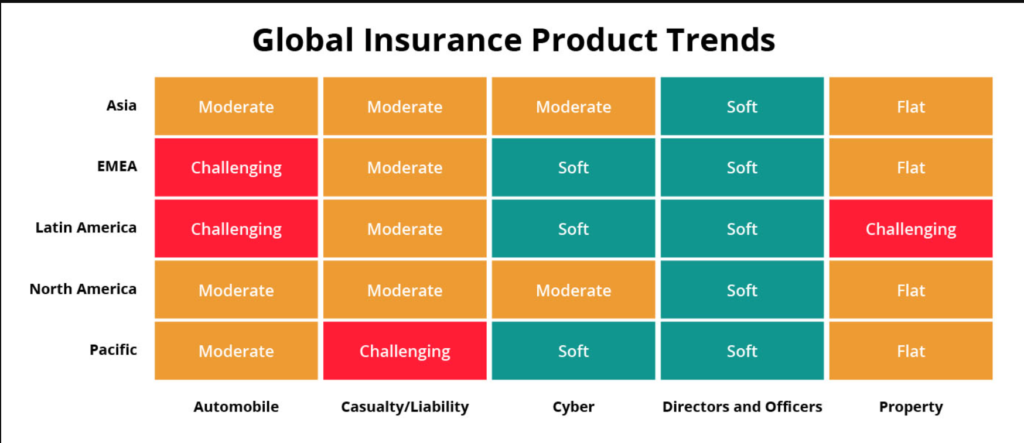

General insurance operates as a continuously developing field. The maintenance of current regulatory requirements along with new risks and policy innovations stands as essential for achieving maximum coverage through general liability insurance because general insurance signifies what?

This document defines actions that help your organization reach its full protection level by reducing financial liabilities from potential legal actions.

Future Trends in general liability insurance: What is general insurance meaning?

Company liability insurance will evolve based on moving business risks and technological progress in future years. A set of emerging factors will modify the future direction of the insurance industry during the next few years.

Technological Integration

- Big Data & Analytics: The rise in available data enables insurers to enhance risk evaluation and develop personalized general liability insurance: What is general insurance meaning? policies based on precise accuracy.

- Artificial Intelligence:Insurers combine Artificial Intelligence with automation to achieve efficient demographics inspection by reducing operational errors throughout workflows.

- Blockchain Solutions: Blockchain technology appears as a modern solution by offering improved transparency with robust protection standards for the industry.

Customizable Coverage

Niche business operations will drive higher demand for customized insurance solutions among providers. Present-day insurance providers have begun adopting flexible policies which enable modification across all coverage parameters. The adaptable nature of general liability insurance makes it suitable for organizations of any size through this approach.

Enhanced Risk Prevention

Risk prevention technologies now function as part of integrated insurance packages. Real-time monitoring systems together with driver-assist features in fleets and cybersecurity solutions have the potential to minimize the incidents leading to general liability insurance claims. General liability insurance: What is general insurance meaning?

Regulatory Developments

Growing market requirements lead governments around the world to transform their rules regarding liability insurance. Business owners need to track developing policies because this ensures their general liability insurance: What is general insurance meaning? policies maintain compliance with evolving laws and industry standards.

External Resources or More Information

Top authoritative resources exist to enhance your reading experience based on the discussed topics as follows:

- Wikipedia – General Liability Insurance

- Investopedia – General Liability Insurance Explained

- Insurance Information Institute

- Is Cyber Insurance Coverage SIlverfort Best Choice

- 100% Best Home Insurance Quotes Comparison Online

- Motorcycle Accident Lawyer:100% Best Understanding Of What to Do If There Is a Motorcycle Accident?

- Breaking Retirement Survivors Disability Insurance News: Max Monthly Benefit Reaches $4,018 in 2025!

- Buy car insurance online for new car? 100% Safe Information With Us

- 100% Ultimate Guide to Mortgage Pre Approval Requirements: What Are Pre-Approval Requirements?

These resources deliver extensive information about insurance that functions as helpful reference points for exploring general liability insurance definitions: What does “general insurance meaning” entail?

Conclusion

Modern risk management depends heavily on the fundamental aspect of general liability insurance: What is general insurance meaning? General liability insurance protects businesses through historical development to modern applications which remains vital for unforeseen liability protection. Corporate credibility improves through this insurance because it both protects financial losses and enables business operations to continue during emergencies.

Strengthen your financial decisions by comprehending the details of general liability insurance coverage including meaning of general insurance and processes of claims management combined with industry-specific codes including NJ insurance code lookup and Progressive insurance ID number 3 digits as well as What is the 3 digit code for Progressive insurance NJ and Who owns NFP insurance and GEICO Insurance Code ny and Progressive insurance 3 digit code NY and Auto Insurance codes.

You should examine your current risk management approach and speak with experts to compare policies in order to choose a plan which perfectly aligns with your business needs. Your current decision should be well-informed because it will protect your business operations for many decades ahead.

Review your risk protection approach immediately: Research all general liability insurance options including their definition while consulting a reliable insurance broker about unique coverage that safeguards your enterprise’s upcoming prospects.

Monitoring insurance complexity requires you to stay updated about market trends. The insurance sector will use combination methods of individualized coverages and technological innovations with advanced risk governance systems to solve modern challenges.

You have gone through our complete guide exploring the meaning of general liability insurance which we appreciate. The acquired knowledge will lead you toward establishing a forward-focused resilient business that succeeds in current market transformations.

To get actionable tips on how to protect your business against the unexpected and what is happening in the market and insurance world, please check out our full library of expert resources and industry analyses. It may be one phone call to one of our specialists that could help you build that final piece of your financial security architecture.

This is where your journey to mastering risk management and protecting your business begins and ends. Discover what’s possible with general liability insurance: What is general insurance meaning? and secure your future today!